lakewood co sales tax online

Community government and strategic partnerships allow Lakewood to provide your business with all the information necessary to succeed and thrive in our community. To qualify for exemption an organization must.

5418 E Hinsdale Pl Centennial Co 80122 3 Beds 3 Baths Hinsdale Centennial Home Decor

Wayfair Inc affect Colorado.

. Revenue online rol sales. The minimum combined 2022 sales tax rate for Lakewood Colorado is. For definition purposes a sale includes the sale lease or rental of tangible personal property.

This is the total of state county and city sales tax rates. To figure out the taxes on a piece of property with a total assessment of 23377808 the average assessment for a residential property in Lakewood Township in 2011 you would divide 23378808 by 100 233788 and multiply that figure by the tax rate 2. State of Colorado Sales Tax.

Appointments are not required to visit the CDOR Cashiers Office but are encouraged for marijuana businesses making cash payments. Businesses located in Belmar or the Marston Park and Belleview Shores districts have different sales tax rates. The remainder of the.

The Belmar Business areas tax rate is 1. Cash payments can only be made at the Pierce Street Department of Revenue Location inside the DMV - Entrance A. Write the Colorado Account Number CAN for the sales tax account on the check.

Retail Sales Tax A 35 Sales Tax is charged on all sales in the City of Englewood except groceries. The Lakewood Colorado sales tax is 750 consisting of 290 Colorado state sales tax and 460 Lakewood local sales taxesThe local sales tax consists of a 050 county sales tax a 300 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc. Sales tax returns may be filed annually.

Whether you are a resident or a visitor Lakewood offers much in services shopping entertainment and business opportunities. The Colorado sales tax rate is currently. Lakewood co sales tax online filing.

The Lakewood Washington sales tax is 990 consisting of 650 Washington state sales tax and 340 Lakewood local sales taxesThe local sales tax consists of a 340 city sales tax. City of lakewood 480 s. Log in to Revenue Online.

The County sales tax rate is. The 2010 tax rate for Lakewood Township is 2308 for every 10000 of assessed value. All businesses selling goods in the City must obtain a Sales and Use Tax License.

Sales Use Tax System SUTS State-administered and home rule sales and use tax filing. If you filed online or with a tax software and want to pay by check or money order. Some Colorado home-rule cities that collect their own local sales tax charge a sales tax on certain services.

Filing frequency is determined by the amount of sales tax collected monthly. For additional e-file options for businesses with more than one location see Using an. Colorados Tax-Exempt Forms.

After you create your own User ID and Password for the income tax account you may file a return through Revenue Online. Registration for summer programs opens April 28 at 10 am. If you have more than one business location you must file a separate return in Revenue Online for each location.

The Lakewood Sales Tax is collected by the merchant on all qualifying sales made within Lakewood. Note that in some retail areas of the City a Public Improvement Fee PIF may be charged to reimburse the developer for on-site improvements. If you close your Sales Tax LicenseRenewal account it will not close your entire Sales Tax account.

15 or less per month. The tax rate for most of Lakewood is 75. Lakewood Economic Development makes sure your start-up existing or expanding business benefits from the Citys collaboration and support.

Did South Dakota v. Contact those cities directly for further information. Payment After Filing Online.

City of Lakewood Sales Tax. Sales Tax Rates With the exception of the Belmar Business area the sales tax for Lakewood is 3. The lakewood colorado sales tax is 750 consisting of 290 colorado state sales tax and 460 lakewood local sales taxesthe local sales tax consists of a 050 county sales tax a 300 city sales tax and a 110 special district sales tax used to fund.

Manage your tax account online - file and pay returns update account information and correspond with the Lakewood Revenue Division. For more information visit our ongoing coverage of. The City of Lakewood allows qualifying 501c3 organizations an exemption from Lakewood sales tax when they purchase goods and services for their regular charitable functions and activities.

The City portion 3 must be remitted directly to the City of Lakewood. When making a cash payment be sure to bring your tax billpayment voucher. Download all Colorado sales tax rates by zip code.

Filing Frequency Due Dates. Groceries are exempt from the Lakewood and Washington state sales taxes. Choose from art dance history fitness outdoors and sports.

If this rate has been updated locally please contact us and we will update the sales tax rate for Lakewood Colorado. The sales tax rate for Lakewood was updated for the 2020 tax year this is the current sales tax rate we are using in the Lakewood Colorado Sales Tax Comparison Calculator for 202223. Register for summer programs.

Go to the account you want to close and click Additional Actions For Sales Tax accounts be sure to select the Sales Tax account not your Sales Tax LicenseRenewal accounts. Lakewood Township is the most populous township in Ocean County New Jersey United States. On april 2 2019 the voters of grand junction authorized a 05 increase in the sales and use tax rate for the city of grand junction.

There are a few ways to e-file sales tax returns. City of Lakewood Accommodations Tax. Include the filing period dates and the words Sales Tax Return on the check.

License My Business Determine if your business needs to be licensed with the City and apply online. The Lakewood sales tax rate is. You can find more tax rates and allowances for Lakewood and Colorado in the 2022 Colorado Tax Tables.

Lakewood in Colorado has a tax rate of 75 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Lakewood totaling 46. The PIF is not a City tax but rather a fee the. Make the check or money order payable to the Colorado Department of Revenue.

56 Off Was 29 99 Now 12 99 Lily Jack White Red Four Piece Outfit Baby Clothes Sale Kids Outfits Girls Free Baby Stuff

Sales Use Tax City Of Lakewood

Business Licensing Tax City Of Lakewood

Business Licensing Tax City Of Lakewood

How Are Pch Winners Notified Lotto Winning Numbers Sweepstakes Winner This Or That Questions

Homes For Sale Real Estate Listings In Usa Investment Property Property Tax Real Estate Buying

File Sales Tax Online Department Of Revenue Taxation

Hello November 2020 Https Boldrealestategroup Com Hello November 2020 Hello November Days To Christmas Florida Real Estate

Business Internetmarketing Kindlebooks Marketing Marketingadvice Marketingtips Selfhelp Hvac Company Internet Marketing Free Internet Marketing

File Sales Tax Online Department Of Revenue Taxation

File Sales Tax Online Department Of Revenue Taxation

Mirror Console Table Mirrored Console Table Mirrored Furniture Furniture

Ranch Style Ranch Style Ranch House Built In Cabinets

Business Licensing Tax City Of Lakewood

Business Licensing Tax City Of Lakewood

Top 3 Don Ts Of House Landscape Design Seattle Homes For Sale We Buy Houses Seattle Homes

Business Licensing Tax City Of Lakewood

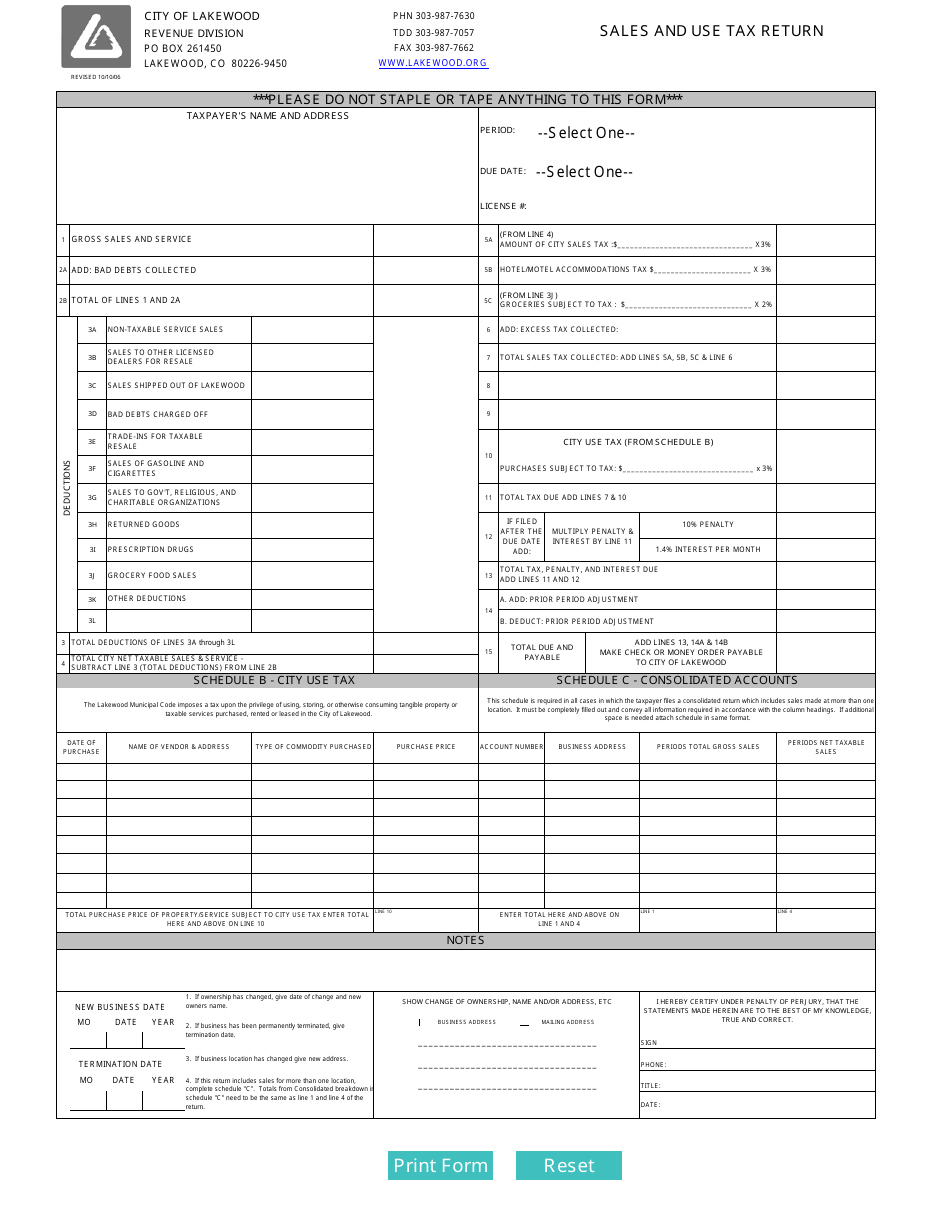

2006 City Of Lakewood Sales And Use Tax Return Form Download Fillable Pdf Templateroller