vanguard tax exempt bond etf review

How has Vanguard Tax-Exempt Bond ETFs stock performed in 2022. Learn About Our ETFs.

Learn About Our Active ETF Funds.

. It generally appeals to investors in higher tax brackets. VTEB entered into oversold territory changing hands as low as 4907 per share. Learn everything about Vanguard Tax-Exempt Bond ETF VTEB.

The investment seeks to provide current income that is exempt from both federal and New York personal income taxes. To see the profile for a specific Vanguard mutual fund ETF or 529 portfolio browse a list of all. Gain market insights and learn the latest news about Municipal Bonds Muni Bond ETFs.

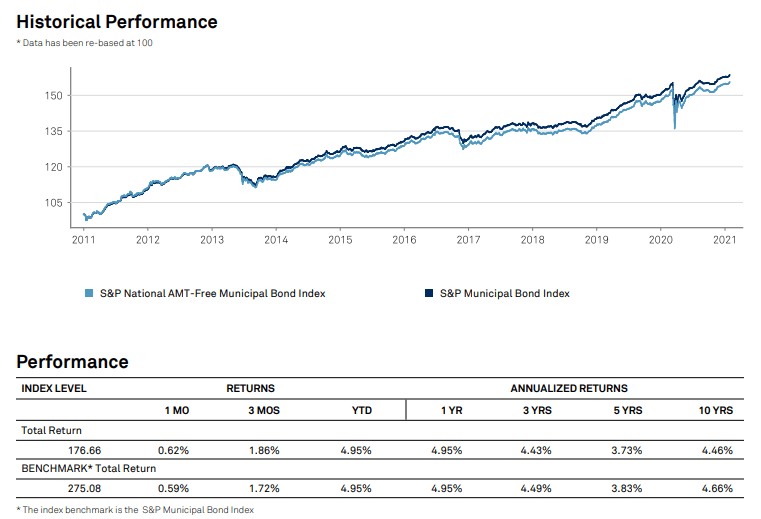

See Vanguard Tax-Exempt Bond Fund performance holdings fees risk and other. A 5-year return of 453 and a 10 year return of 484. A high correlation between funds may mean that your portfolio of funds is not as diverse as you might want it to be.

A high-level overview of Vanguard Municipal Bond Funds - Vanguard Tax-Exempt Bond ETF VTEB stock. Active Transparent Tax-Efficient Time-Tested Core Holdings. The fund invests primarily in high-quality municipal.

The Best ETFs for Taxable Accounts. Summit Asset Management LLC Buys BTC iShares Floating Rate Bond ETF Vanguard Ultra-Short Bond ETF Vanguard Tax-Exempt Bond ETF Sells Peloton Interactive. Vanguard mutual funds Vanguard ETFs Vanguard 529 portfolios.

The Fund invests at least 80 of its assets in longer. Learn About Our Active ETF Funds. 9 hours agoIn trading on Monday shares of the Vanguard Tax-Exempt Bond ETF Symbol.

It has an outstanding 3 year return of 765. Although the income from municipal bonds held by a fund is exempt from federal tax you may owe taxes on any capital gains realized through the funds trading or through your own. The Fund seeks to provide high current income that is exempt from federal income taxes and to preserve investors principal.

Title for data aware. Vanguard Tax-Exempt Bond ETFs stock was trading at 5491 at the beginning of 2022. Learn About Our ETFs.

The Vanguard High Yield Tax Exempt Fund falls within Morningstars muni national intermediate category. VTEB is an ETF whereas VWAHX is a mutual fund. Ad Signature Active Management Now as ETFs.

Morningstar says the fund looks conservative compared with. Learn Why Bond Market Complexities Call For An Active Approach. The chance that all or a portion of the tax-exempt income from municipal bonds held by the fund will be declared taxable possibly with retroactive effect because of.

Vanguard Tax-Exempt Bond ETF VTEB Next up the Vanguard Tax-Exempt Bond ETF was developed to track an underlying benchmark that tracks investment-grade. Ad PIMCO Has Been At The Forefront Of Active Fixed Income ETF Investing For Over A Decade. VTEB has a lower expense ratio than VWAHX 005 vs 017.

Vanguard Tax-Exempt Bond offers a broad portfolio of investment-grade tax-exempt municipal bonds at an attractive price earning a Morningstar Analyst Rating of Gold. Indeed the performance of this Vanguard bond fund almost resembles the. The Vanguard Long-Term Tax-Exempt Fund is designed specifically for these high-income investors.

Free ratings analyses holdings benchmarks quotes and news. Vanguard Tax-Managed Balanced Fund VTMFX Consider VTMFX to meet your needs if youre looking for a one-fund solution for your taxable account. This low-cost municipal bond fund is designed for investors who want a modest level of federal tax-exempt income.

ITOT iShares Core SP Total US. See Vanguard Tax-Exempt Bond Fund VTEAX mutual fund ratings from all the top fund analysts in one place. While other tools may compare funds only to the SP 500 or 500 Index.

Vanguard Tax-Exempt Bond offers a broad portfolio of investment-grade tax. Ad Signature Active Management Now as ETFs. Ad Gain market insights and learn the latest news about Muni Bond ETFs.

Stay up to date on the latest stock price chart news analysis. IVV iShares Core SP 500 ETF. VTEB has a lower 5-year return than VWAHX 177 vs 262.

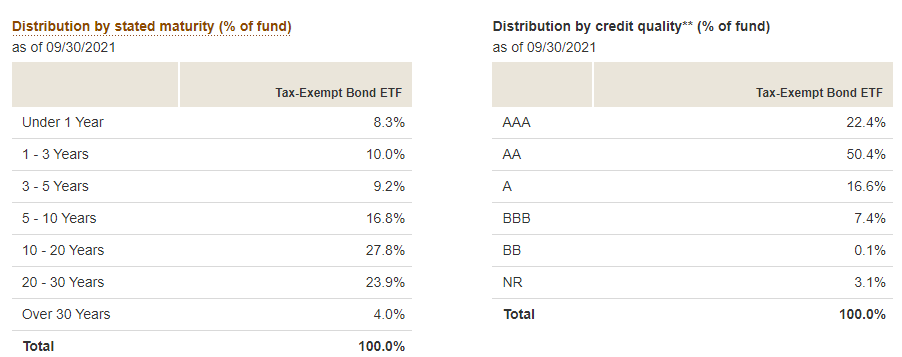

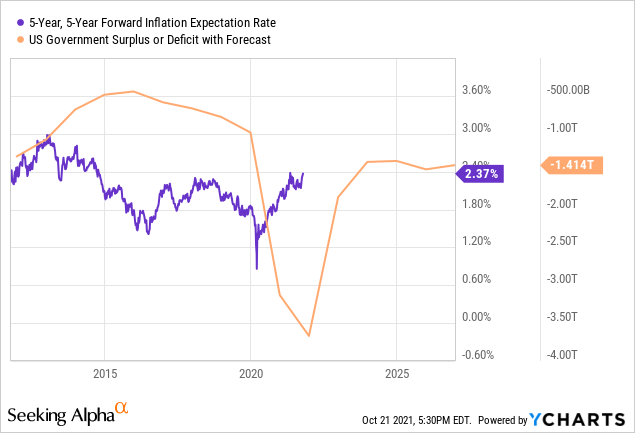

About Vanguard Tax-Exempt Bond ETF The investment seeks to track the Standard Poors National AMT-Free Municipal Bond Index which measures the performance of the investment. Active Transparent Tax-Efficient Time-Tested Core Holdings. IXUS iShares Core MSCI Total International.

Vanguard Tax-Exempt Bond offers a broad portfolio of investment-grade tax-exempt municipal bonds at an attractive price earning a Morningstar Analyst Rating of Gold.

![]()

7 Best Vanguard Bond Etfs For Your Portfolio 2022 Review Investor Impact Lab

Vteb Vanguard Tax Exempt Bond Index Fund Etf Shares Etf Quote Cnnmoney Com

Vteb Vanguard Tax Exempt Bond Etf Vanguard Advisors

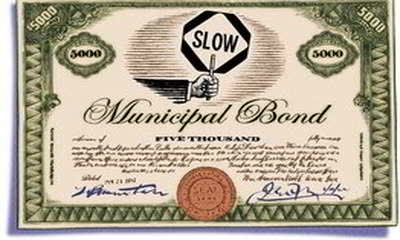

Municipal Bond Yields A Renaissance Of Tax Exempt Income

Vanguard Tax Exempt Etf Nysearca Vteb For Investors Wanting Quality Without Leverage Seeking Alpha

Municipal Bond Yields A Renaissance Of Tax Exempt Income

Municipal Bond Yields A Renaissance Of Tax Exempt Income

Vteb Vanguard Tax Exempt Bond Etf Provides 2 Yield With Less Interest Rate Risk Than Many Bond Funds Nysearca Vteb Seeking Alpha

Vanguard Tax Exempt Etf Nysearca Vteb For Investors Wanting Quality Without Leverage Seeking Alpha

Vteb Large Inflows Detected At Etf Nasdaq

How To Pick A Muni Bond Etf Etf Com

Vanguard Tax Exempt Etf Nysearca Vteb For Investors Wanting Quality Without Leverage Seeking Alpha

Vteb Vanguard Tax Exempt Bond Etf Provides 2 Yield With Less Interest Rate Risk Than Many Bond Funds Nysearca Vteb Seeking Alpha

Vanguard Tax Exempt Etf Nysearca Vteb For Investors Wanting Quality Without Leverage Seeking Alpha

Vanguard Tax Exempt Bond Etf Vteb Stock Price News Info The Motley Fool

Vteb Vanguard Tax Exempt Bond Etf Provides 2 Yield With Less Interest Rate Risk Than Many Bond Funds Nysearca Vteb Seeking Alpha

![]()

7 Best Vanguard Bond Etfs For Your Portfolio 2022 Review Investor Impact Lab